The Challenges of Omnichannel Retailing

Brick and mortar stores are the single most important touchpoint a retailer has in growing overall sales. Digitally native brands are opening physical stores to compete more effectively for the hearts of the consumer, while traditional retailers are reinventing themselves to stay relevant in the new retail world. Today, specialty retailers are beginning to recognize that their physical and digital stores are co-dependent. However, challenges exist when balancing in-store activities to meet omnichannel demands.

The goal of omnichannel retailing is to create a consistent customer experience across channels. This through a frictionless and unified commerce. The first speed bump that most traditional retailers encounter in this journey is internal competition between the channels. Most retailers started their omnichannel journey by allowing digital returns at stores. Then they implemented some form of endless aisle. At their foundation, traditional retail labor planning models rely on a sales forecast based on in-store demand generation. Neither of these omnichannel activities add to that sales forecast. Therefore these digital activities were either not funded, or funded via a ‘band-aid’ approach. That’s when the fight started…

Omnichannel Retailing: The Two Stages

Long before omnichannel retailing was a ‘thing’, few retailers paused to think that each transaction has two stages: demand generation and order fulfillment. A customer would walk into a store, interact with an associate to select items, and then walk to cash to pay. In today’s omnichannel world, demand can be generated either in-store or online. Orders can be fulfilled from a DC (Distribution Center) or any store in the chain. The two stages are now clearly distinct.

Why is this important to note? Simple. Demand generating activities influence current and future sales forecasts, which in turn serve as a basis for your labor planning model. But if demand is generated in one store, but the order is fulfilled from another store or a DC, does the fulfilling store receive credit? Or worse, if the customer makes their purchase decision while in-store but then goes home to order online, will the store ever receive credit for the sale? If not, they have spent the labor generating the demand but will not be rewarded with the labor budget next year. The same is true for digital order fulfillment activities. Be they ‘click and collect’ or endless aisle activities such as ship-from-store – how is the labor funded? And perhaps the most important question of all, how will the store team’s incentives be impacted?

Available Capacity and Store as Markets? What Does it Mean for Me?

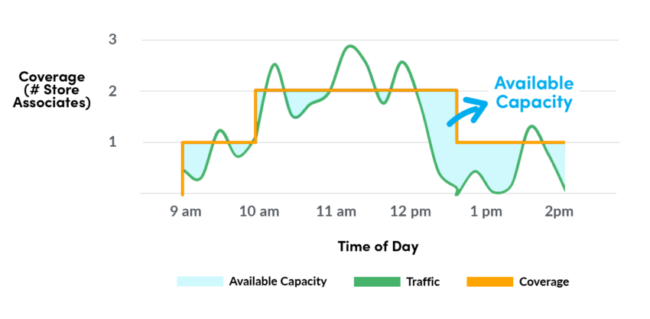

Available Capacity: Specialty retailers often have Available Capacity (or “AC”) at their stores to perform some of these digital order fulfillment tasks without adding more labor. Minimum staffing levels and minimum shift lengths produce schedules that cannot exactly align the traffic demand forecast. For instance, if you have a store with a min staff level of 2 store associates, but will only have 5 customers cross your lease line on Monday morning between 10 and 11, those 2 staffs have AC within that hour to do digital tasks. Before adding more labor hours to your stores, consider your AC to perform digital tasks in-store.

Stores as Markets: 75% of digital returns are completed in-store. However, many retailers lack the ability to separate these returns from brick and mortar sales, resulting in digital returns negatively impacting a store’s net sales and the store staff’s incentives. And what is worse, store staff may only have visibility to their own store’s brick and mortar sales and traffic. They may only see both numbers declining year over year, even though their company’s total top line is growing. Without being told any different, they may believe that they will be the next casualty of the supposed ‘Retail Apocalypse’. In 2018, a study by ICSC showed a clear connection between opening or closing physical stores and the volume of e-commerce traffic. Technology exists today to geolocate digital sales to a physical store, allowing a retailer to look at a store as a market (both in-store and online). In this way, you can produce a pure ‘brick & mortar’ view of sales, a pure digital view of sales, and a combined market view of sales.

Strategies to Improve Your Store-Level Digital Interactions

Retail is constantly evolving and solutions to existing problems are being tested every day. Important strategies should be implemented to improve the execution of your store-level digital interactions and the overall customer experience of your brand. These include:

- Forecast Available Capacity: Use advanced systems to forecast each store’s daily available capacity and redirect pick & ship orders through your OMS to them. This will leverage your labor potential;

- Stores as Markets: Report each store as a market by geolocating each digital order to the nearest demand-generation store. Accumulating both digital and brick-and-mortar sales into the store’s market sales will show the total potential of your store;

- Fund Selling Labor Hours based on Market Sales: 73% of shoppers use multiple channels in their shopping journey. Productivity indicators that drive labor hours should be expanded to include the influence stores have on total market sales. This means selling labor hours should be measured on both brick-and-mortar and online sales. This does not mean that your total costs should increase!

- Fund Non-Selling Labor Hours for Digital Order Fulfillment Activities: once your available capacity is exhausted, fund your digital order fulfillment tasks by allocating labor based on forecasted volumes;

- Incentivize Stores on their Markets: Consider compensating your stores’ teams based on market sales instead of just brick-and-mortar sales. This does not mean your total costs should increase!

To stay relevant in the new retail world, retailers must successfully make the transition to omnichannel initiatives while planning their labor budget and store-level activities. Everyone in your organization must understand, support, and effectively plan the goals and objectives of your omnichannel initiatives (including how they are incentivized). This will allow you to align your stores’ staff to your omnichannel goals and foster your brand’s customer experience.

Author:

Dave Loat is the President and co-founder of StoreForce. Dave has over 25 years of experience working with some of the best-known brands in retail and has incorporated these learnings into the StoreForce’s solution. He is truly passionate about store operations. Prior to StoreForce, Dave was a founding partner of Karabus Management, which grew to become the second-largest retail-specific consulting firm in the world. While at Karabus, Dave had the experience of working with over 100 retailers.

Recent Blog Posts

Insights from Industry Leaders at Retail Technology Show 2024

The Customer Experience Drives UK Retailers! There was a buzz in the air last week in London Retail Technology Show 2024 was crackin' with retailers looking for new solutions and...

READ MORE

The Top 7 Questions Asked at the Fabletics Road Show

The StoreForce Road Show was a fantastic event, bringing together retailers from all over Los Angeles County for breakfast and a lively discussion session with Fabletics’ Senior Director of Retail...

READ MORE

Future Stores 2024: Key Takeaways from StoreForce

Future Stores 2024 was an incredible event for brick-and-mortar retail, bringing together industry leaders to discuss and explore the latest trends and innovations As a participant, StoreForce...

READ MORESchedule a Consultation With Our Retail Experts Today

Contact us today for a 15-minute conversation on how StoreForce can help you drive store performance and execution for less than the cost of 1 transaction per week. Learn how retailers all over the world are driving performance and customer experience through our solution made exclusively for Specialty Retail.