Blog Post

Emerging Trends as Retailers Move Cautiously Forward

June 8, 2020 in COVID-19, Thought Leadership

Consumers have started to shop again in brick and mortar stores. They are exhibiting clear changes in both the types of retail merchandise they are looking for and where and when they wish to purchase. At StoreForce, we have analyzed top Key Performance Indicators (KPIs) and the day-to-day behavior to identify current reopening trends that can provide important insights as you look to build back your business.

The StoreForce Way to Reopening Stores: Control, Caution, and Resume

As retail outlets reopen throughout the world, retail leaders and operational teams had been tasked with the challenge of how to manage all new aspects of store operations and sales. It is all a tall order! StoreForce has developed a 3 Phased Framework to help retailers navigate the reopening process to achieve their store sales and labor targets. Check out our latest on-demand webinar where we discuss in-depth ideas surrounding our reopening framework.

StoreForce Phased Approach to Reopening Stores

The key to this approach is to establish a revised labor scheduling baseline, formulate accurate store opening hours, and incorporate regulatory guidelines for staffing levels that must be observed upon reopening. With so much uncertainty, any scheduling assumptions used prior to store closures may no longer be accurate as retailers reopen. They do, however, provide a valuable baseline that should be used to validate any new plans and to track your current performance against plan.

Phase 1: Control – Back to Basics

- In this phase, you must establish your base labor hours required during the initial few weeks of reopening. Refer to your non-peak store hours as a baseline.

- After a couple of weeks, understand how consumers are responding before moving into what we refer to as the Caution phase. Is traffic going up? Are your store sales improving and positively performing week on week for each store/region? Do you need to add more additional labor hours? How are regulatory requirements affecting hours consumption?

Phase 2: Caution – Adjust to Your Baseline

- Learn from your sales and traffic trends and revise your base labor hours as needed; begin to reforecast sales targets and labor requirements cautiously.

Phase 3: Resume – Getting Your Business Back to Normal

- Plan sales and labor targets as the business ramps back up. Track your performance against your revised sales plans and remain flexible in adjusting your sales targets and labor spend while you continue to analyze sales data/trends and see how consumers are reacting.

When Do I Know If I am Ready for the Next Stage?

Not every store is like another, each of them has its own behavior. Not all stores will move to the Cautious or Resume phase at the same time. This will depend upon their region and how consumers are reacting. The right time for moving from one stage to another will depend on:

- Where your stores are located and what the current regulations in place are. For instance, what is the current capacity allowed in your region? Is it 25%? 50% capacity? Or no restriction?

- How your customers react to your new reopening processes. What is their behavior? Are you seeing any trend or positive pattern?

- How well staffed your stores are. Think about the need to increase beyond your base labor hours and yet, suddenly, there are no associates available to cover these added shifts. Are you ready and/or able to start labor pooling your staff from one store to another within the same region?

How Are Consumers Reacting to the Reopening of Stores?

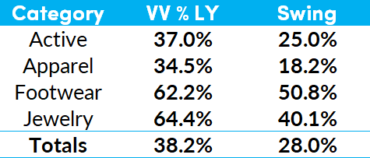

How have shoppers interacted with retail brands since stores reopened? StoreForce has analyzed consumer buying behaviors throughout North America to date. Our analysis indicates that the propensity to buy is much higher when compared to last year. We observe this both in the Visit Value and Swing metrics. We refer to Visit Value as the value received on average from each shopper that crosses your lease line. In other words, Sales divided by Traffic. Swing is a powerful indicator, a StoreForce metric used to measure Year on Year (YoY) change in Sales less the Year on Year (YoY) change in Traffic. A positive Swing number indicates a good result.

What we are seeing in the market is unprecedented. The dramatic increase of a Year on Year Swing and Visit Value has never occurred in the past. Those who have the will to cross your lease line are determined to buy something! See below how consumers are reacting per retail category.

Other Key Stats Identified

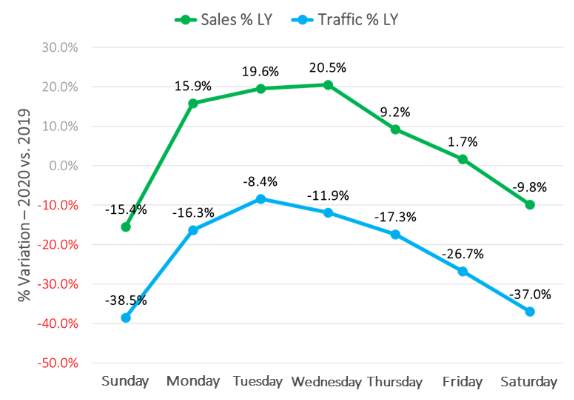

Customer Patterns: Weekdays vs. Weekends

Another trend we’ve seen is in consumer intention on weekdays vs. weekends when comparing year on year. Overall, retailers are beating YoY Sales on weekdays, and down on weekends. In addition, the store traffic curve is flattening during the week, with weekdays higher and weekends lower, though the weekend remains the highest volume period.

How to Win?

- Every person crossing your lease line presents an even greater opportunity to service and sell than before the pandemic. Make sure that you provide the appropriate amount of attention to each shopper. As a result, you will maximize your return on each customer visit.

- The flatter traffic curve, with more volume mid-week and less on weekends, will allow you to continue using base hours longer than if the current curve reflected the historical pattern.

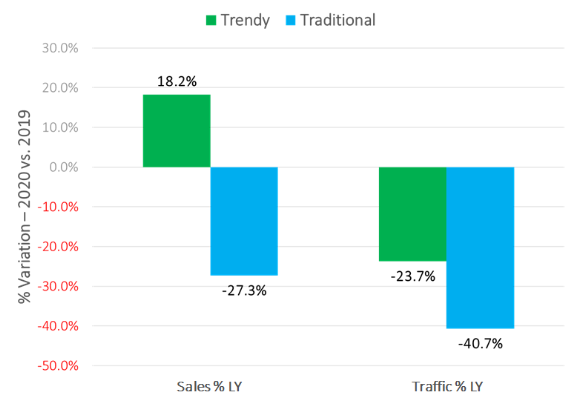

Trendy vs. Traditional: Who Is Winning?

Trendy retailers have more fashion-forward merchandise, less ‘basic’ stock in their assortment, and generally cater to a younger consumer. Traditional is as it sounds – a less risky merchandise style and generally caters towards the 30+ crowd.

The younger shopper is currently more willing to get out and shop! YoY results for Trendy is up a whopping 42% over Traditional in overall store sales. Trendy retailers are beating LY numbers and Traditional going down to LY. This may also reflect that, while people continue to work from home in many jurisdictions, their need to ‘refresh’ their business casual wardrobe (traditional) has diminished.

How to Win?

- Many Trendy retailers are showing signs that they need to start adding flex hours in some locations to ensure that there is enough staff available to meet their customer’s needs. It is the right timing to move into the Caution Phase.

- Most Traditional retailers appear to be fine to continue scheduling with base hours coverage only. It is recommended to stay in the Control Phase and being selective and cautious when adding additional hours.

Conversion Rate Is King!

With reduced traffic in-store, one KPI in proving crucial in this initial period: Conversion rate is retailers’ biggest ally right now. Consumers are visiting stores with the intent to buy. If they cross your lease line is because they’ve already planned to purchase something and/or have the desire to shop.

Ensure you have tested and retested the buyer’s in-store journey and how you welcome your customers back. From assuring consumer confidence and having the right safety protocols in place to ensuring you have the right merchandise mix in-store with the correct product knowledge and training for your associates, in other words… a great customer experience!

“If you think about the trend in brick-and-mortar retail over the last few years, [it] has been the trend of lower traffic, and higher conversion … and making every visit count, [ ] I think we’re just moving into an era where that’s going to be even more exaggerated, and even more important for us to really provide that excellent service and ensure that we are driving back conversion.”

Crate & Barrel CEO Neela Montgomery

StoreForce is here for anyone who wishes to have a 1-on-1 conversation. We will share insights based on the work we are doing within our client base and the common challenges we are all seeing and working through. Feel free to reach out to us at any time.

StoreForce can help you to achieve your retail goals and labor planning effectiveness. Interested in learning more? Contact us and engage with one of our retail experts as to how we can future proof your overall retail store management.

Author:

Dave Loat is the President and co-founder of StoreForce. Dave has over 25 years of experience working with some of the best-known brands in retail and has incorporated these learnings into the StoreForce’s solution. He is truly passionate about store operations. Prior to StoreForce, Dave was a founding partner of Karabus Management, which grew to become the second-largest retail-specific consulting firm in the world. While at Karabus, Dave had the experience of working with over 100 retailers.

Recent Blog Posts

Insights from Industry Leaders at Retail Technology Show 2024

The Customer Experience Drives UK Retailers! There was a buzz in the air last week in London Retail Technology Show 2024 was crackin' with retailers looking for new solutions and...

READ MORE

The Top 7 Questions Asked at the Fabletics Road Show

The StoreForce Road Show was a fantastic event, bringing together retailers from all over Los Angeles County for breakfast and a lively discussion session with Fabletics’ Senior Director of Retail...

READ MORE

Future Stores 2024: Key Takeaways from StoreForce

Future Stores 2024 was an incredible event for brick-and-mortar retail, bringing together industry leaders to discuss and explore the latest trends and innovations As a participant, StoreForce...

READ MORESchedule a Consultation With Our Retail Experts Today

Contact us today for a 15-minute conversation on how StoreForce can help you drive store performance and execution for less than the cost of 1 transaction per week. Learn how retailers all over the world are driving performance and customer experience through our solution made exclusively for Specialty Retail.