Blog Post

Pre-Holiday Retail Trends 2020

November 24, 2020 in COVID-19, Retail Trends, Thought Leadership

In the pre-Covid world, holiday shopping trends were, if not predictable, then quite reliable for retailers. The season would kick off with Black Friday (so named as it is the date in the year when a retailer’s bottom line would finally turn from red to black) and continue through the holiday period. While there were always the planful shoppers, many would wait until the last minute to shop, wandering the mall on Christmas Eve, searching for that perfect last-minute gift.

Today, less than a year later, life is different. Covid-19 has severely disrupted retail, forcing stores and malls to quickly adapt to ever changing conditions and regulations. Although holiday retail sales are still in full swing, customer behavior has changed. Whether customers are shopping digitally or physically, there are some different trends to note this year.

As we have previously outlined in another blog, Emerging Trends as Retailers Move Cautiously Forward, we have identified two types of customers, trendy and traditional. Trendy being a younger, bolder shopper, and traditional being an over-30 crowd who is more conservative in their spending and buying habits.

Here are some holiday trends for Specialty Retail that we’ve observed this year.

Pre-Holiday Traffic May Be Down, But Spending is Up

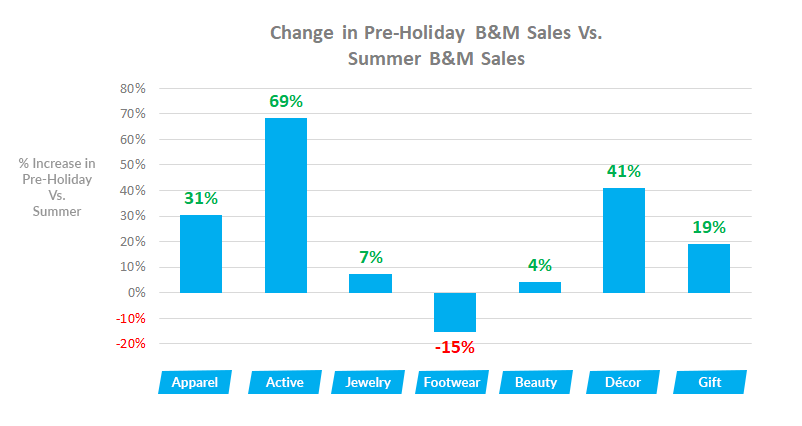

Although traffic continues to remain low at brick and mortar stores, sales have actually increased since the summer for many of our clients. Retail verticals like Gift (up 19%), Apparel (up 31%) and Décor (up 41%) are seeing higher sales in the last four weeks than they did during the summer. Customers are shopping with a purpose – the propensity to buy is there. The propensity to buy, in fact, it is much higher than last year, with Visit Value increasing 30% YoY. No more meandering through malls or window shopping: those who come are there with a purpose and with an intent to buy.

When comparing data this past summer versus the last four weeks, there is quite an interesting story to be told. Without doubt, traffic is down overall this year from last year; but what’s interesting is that traffic has increased in the last four weeks compared to the past summer when stores reopened.

Traffic in verticals like Jewelry (up 11.5%), Gift (up 13%), Beauty (up 14%) and Décor (up 62%) have all seen a substantial increase during the last four weeks when compared to the summer. This could be due to various reasons: Décor, for example, is doing well because people are staying home and renovating their homes; Jewelry may be the beneficiary of people taking relationships to the next level during the pandemic. Whatever the reason, these verticals have seen an improvement to their results as the global pandemic continues.

Earlier Planning & Shopping

When the stores re-opened in the summer, the government was still issuing stimulus cheques. With this new-found disposable income, many “Trendy” (younger) shoppers were eager and enthusiastic to get out and shop. Meanwhile, the older traditional shoppers were nervous about going into crowded areas, so they either switched over to digital channels or were less likely to shop. Once things began to get somewhat back to normal, the “Traditional” shoppers started venturing out again, while the novelty of going out (coupled with the ending of the stimulus cheques) wore off for the trendy shoppers.

Overall, we are seeing holiday shopping already under way, with the rise in sales starting in late October. Customers have begun their holiday shopping earlier this year, and we see this most clearly in our traditional shoppers. With the ever-changing regulatory response to Covid, there is a high degree of uncertainty surrounding non-essential retail store capacities and closures. With a new curfew order implemented this past weekend in California, customers are worried that the remaining states will follow suit. People are concerned about stores shutting down with limited notice, and are seizing the opportunity to get their holiday shopping completed soon as possible.

Peak Day Shifts

Historically, weekends have always been the most popular shopping days. Over the summer, just after stores reopened, traffic patterns shifted towards mid-week. Tuesdays and Thursdays seemed to become very popular days, though Saturday still remained the most important day for shopping. The shutdown may have influenced this – with furloughed or ‘work from home’ shoppers targeting the less crowded mid-week days to do their shopping. And the shopping group most affected by furloughing was the younger, more trendy shopper, while the traditional shopper tended to either stay away all together, or not shift their traditional day of week patterns.

In the past four weeks, it seems that the popular days are shifting back to the weekends. At first glance this appears to be a sign that things are returning more towards normal, but we are also seeing that “Traditional” retailers are starting to out-perform their ‘Trendy’ retail cousins. While the exact reasons are not yet clear, we would presume that it is due to the traditional retail shopper having a higher degree of financial security, and returning in force to buy for the holidays ahead of time.

In summary, the trends leading into Black Friday show the following:

- Specialty Retail is exhibiting a reassuring degree of resilience;

- The “Traditional” shopper (over 30 years old) has already begun holiday shopping, and in effect spreading the holiday curve over a longer period;

- The “Trendy” shopper (under 30 years old), while representing the initial summer surge in retail spending, have cooled off a bit and are not showing the same enthusiasm they did a few short months ago.

We have spoken to many of our clients, and they are not anticipating the actual day of Black Friday to be as busy as prior years. The open hours have been shortened, and they are encouraging shoppers to come in at any time by guaranteeing them Black Friday deals for the whole week (and in some cases the week(s) or even month following). This will stretch out the deals and promotions offered and the peak of sales will also be smoothed out.

This year, retailers need to be agile and flexible to cater to the ever-changing needs of the consumer in this “new normal” of uncertainty. Customers still expect the level of service to be consistent across all sales channels. Offering consistent sales or promotions both online and offline can help to display a cohesion across all sales channels. Planning for BOPIS and BORIS is critical to store success, among other new activities to plan for. Making sure that stores are fully staffed to help in-person customers is just as important as making sure the shipping department is fully staffed to handle the influx of online shipments.

We will update this blog post the week of Black Friday to share trends that we see during that week.

StoreForce can help you to achieve your retail goals and labor planning effectiveness. Interested in learning more? Contact us and engage with one of our retail experts as to how we can future proof your overall retail store management.

Author:

Dave Loat is the President and co-founder of StoreForce. Dave has over 25 years of experience working with some of the best-known brands in retail and has incorporated these learnings into the StoreForce’s solution. He is truly passionate about store operations. Prior to StoreForce, Dave was a founding partner of Karabus Management, which grew to become the second-largest retail-specific consulting firm in the world. While at Karabus, Dave had the experience of working with over 100 retailers.

Recent Blog Posts

Insights from Industry Leaders at Retail Technology Show 2024

The Customer Experience Drives UK Retailers! There was a buzz in the air last week in London Retail Technology Show 2024 was crackin' with retailers looking for new solutions and...

READ MORE

The Top 7 Questions Asked at the Fabletics Road Show

The StoreForce Road Show was a fantastic event, bringing together retailers from all over Los Angeles County for breakfast and a lively discussion session with Fabletics’ Senior Director of Retail...

READ MORE

Future Stores 2024: Key Takeaways from StoreForce

Future Stores 2024 was an incredible event for brick-and-mortar retail, bringing together industry leaders to discuss and explore the latest trends and innovations As a participant, StoreForce...

READ MORESchedule a Consultation With Our Retail Experts Today

Contact us today for a 15-minute conversation on how StoreForce can help you drive store performance and execution for less than the cost of 1 transaction per week. Learn how retailers all over the world are driving performance and customer experience through our solution made exclusively for Specialty Retail.